Get the intelligence you need to drive your counterparty assessments and investing, lending, and financing strategies. The China Credit Analytics platform is your one-stop for advanced credit insights on Chinese public and private companies, bond issuers, and government-related entities (GREs). Now you can leverage the experience, credibility, and methodologies of S&P Global Market Intelligence to: – Identify business opportunities and risks. – Understand the creditworthiness of GREs and local government financing vehicles (LGFVs). – Rely on market-proven and analyst-produced analysis. – Streamline workflows.

A dual language user interface supports both Chinese and English languages. In addition, financial information can be viewed in USD currency as well as CNY to reconcile information.

China Credit Analytics supports numerous workflows: – Fundamental credit research – Credit risk management and surveillance – Credit origination and investment activities

Generate timely credit insights to support your analysis. Leverage differentiated content, localized analytics, qualitative credit scores produced by ratings analysts, and quantitative model-generated credit scores that broadly align with S&P Global Ratings’ credit ratings.

The China Credit Analytics platform enables you to:

Drive decision-making with all the information you need on the country’s bond issuers. Details include ~6K corporate bond issuers with the most up to date financials. Many have credit scores produced by S&P Global (China) Ratings analysts and pre-scored probabilities of default (PDs) from quantitative models calibrated for the China market. In addition, a scoring engine can be used to create additional PDs and credit scores. You can easily identify issuers for comparable analysis or financial due diligence by searching and screening on different dimensions, such as a company’s profile, ownership up and down four levels, fundamentals, credit scores, and more.

You can view extensive bond T&Cs to zero in on recent maturities, outstanding principle, and interest trends. You can also view metrics for a single entity, such as the Bond Active Index, YTM/YTW, durations, and spreads (OAS, Z Spread).

See a rich debt summary that provides a holistic picture of total debt outstanding, bank credit lines, and more. This includes issuer analytics and issuer-level yield curves. You can browse issuer-level risk inputs, such as bond issuance information, total return, and OAS. Plus, an issuer-implied PD term structure is presented from 1month (m) to 5 years. You can also visualize a holding period return (total return) between 1m, 3m, 6m, YTD, and all periods, plus an historical 6m trend.

Delve into single issuance information and analytics when viewing bond issuance details. You can review security details, issue rating and rating movement, issue information, and coupon and spread details. You can also visualize historical changes with bond active volume, YTM and YTW, volatility, Z spread and OAS. In addition, see where the entity lies with the industry issue and issuer number, industry outstanding amount, and historical (up to 1 year) trend on industry YTM and OAS.

Screener: Screen with given criteria and save the screened companies for future analysis.

Bond market overview page with mini screener: Browse issuer-level risk inputs, such as bond issuance information, total return, and OAS and see an issuer-implied PD term structure from 1month (m) to 5 years.

1 S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.

Gain deep insights into the creditworthiness of unrated entities with expert judgment-based Private Credit Analysis (PCA) reports.2 Access 2K+ Private Credit Analysis (PCA) reports for large corporations and financial institutions in China, providing a deep understanding of a specific industry’s or company’s credit risk.

S&P Global (China) Ratings analysts produce these reports by following a stringent analytical process for evaluating publicly available information and performing qualitative analysis that goes beyond modelbased calculations. These unique assessments done by ratings analysts provide credit risk estimates, scores, metrics, and analytical commentary that enable you to assess credit risk, calibrate internal processes, supplement analytical resources, and develop bond pricing references (a premium offering).

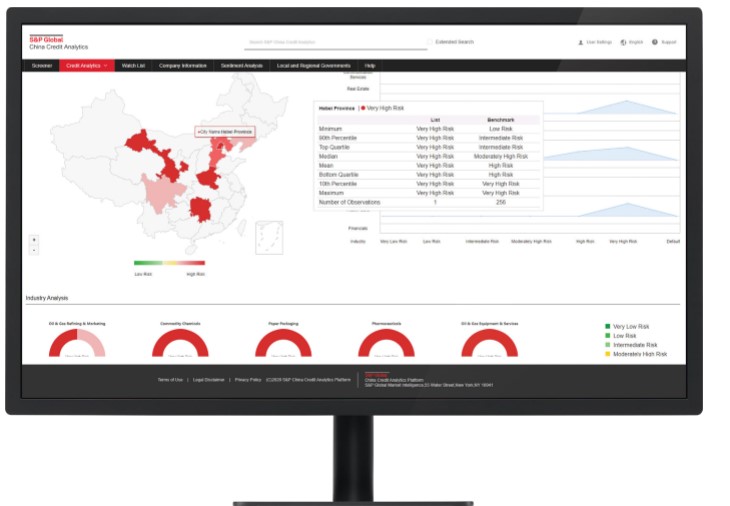

Easily assess extensive PCA details on dedicated pages with a mini screener and visualization charts. You can screen on entities, PCA scores, update date, and LGFV tags, and view updated entities, most of which have the analyst’s name and contact details. Navigating a China map will let you see the best and worst PCA score and more at a provincial level, plus the industry/segment distribution and a median score. The corresponding median bond implied PD within each score can be viewed for those of interest, plus a yield term structure at different PCA score levels. You can also switch between public ratings and PCA scores for corporates and FIs and view a summary of scores/ratings along with score/ratings distributions.

Further expand your view of the unrated universe with model-generated estimates of default risk. Identify untapped potential with data on ~70mn small- and medium-sized enterprises (SMEs), including 1mn+ pre-scored PDs for the larger companies in this universe.In addition, gain further insights on creditworthiness by evaluating differences in PDs relative to industry- and provincial-level benchmarks.

4

2 PCA results are provided by S&P Ratings (China) Co., Ltd (“S&P Ratings”) analysts using simplified analysis based on rating methodology and public information, and do not involve all aspects of credit ratings. PCA results use lowercase letter and the “spc(p)” subscript to differentiate PCA results from S&P Global Market Intelligence PD credit model scores, and credit ratings issued by S&P Ratings.

PCA Score and Public Ratings Distribution

Stay ahead of the curve with innovative sentiment analysis that helps identify potential credit deterioration. Sentiment analysis draws signals from news, media, blogs,and more to provide alerts of all events and hot words relevant for entities in your watch list. There are 165 exhaustive event labels and nine event classifications recognized as positive and negative sentiments.

These are reclassified into eight risk dimensions. Customized alerting at the entity or portfolio level provides the option of altering the frequency, start date, timing, and sentiment language.

Know where to target initiatives by understanding the financial strength of GREs. Zero in on ~600 local and regional governments (LRGs) with data on fiscal income, government fund income, government debt, and more. In addition, assess risks with 2K+ issuers of LGFVs by accessing unique credit scores that reflect the creditworthiness of the associated LRG.

Get a holistic picture of creditworthiness by generating additional quantitative credit scores. Generate your own credit scores by using one of three S&P Global Market Intelligence models: (1) PD Model Fundamentals (PDFN) provides an innovative approach to assess the one- to five-year default risk of SMEs by looking at financial and business risk, (2) CreditModel™ China evaluates the long-term creditworthiness of mid- and large-cap corporates using financial statement and macroeconomic data, and (3) CreditModel LGFVs is specifically designed to evaluate LGFVs. PDFN lets you rely on a global credit assessment methodology that is designed specifically for the Chinese market, enabling granular and globally credible evaluations of credit risk that are locally relevant. PDFN results are calibrated to Chinese default data. CreditModel China produces credit scores that align with a local ratings scale.

Coverage currently include 2K+ LGFVs

China-based Default Model Calibrated to Chinese Default Data

Chinese Provincial- and Industry-Level Benchmarks

~6K Chinese Bond Issuers, Many with Pre-scored PDs

70mn+ Private Company Profiles ~1mn with Pre-scored PDs

2K+ PCA Reports Authored by Analysts from S&P Global (China) Ratings

~14K Chinese Listed Companies

~600 LRGs

Get the details you need to effectively navigate the Chinese marketplace with the powerful China Credit Analytics platform. It’s the unrivalled one stop for advanced credit insights on the country’s public and private companies, bond issuers, and GREs.

Company Tear Sheet: View a company’s business profile along with financial highlights and a credit score. Credit Dashboard: Conduct portfolio surveillance for credit health across sectors and regions.

Streamline workflows by leveraging robust credit workflow tools. Strong functionality in the China Credit Analytics platform lets you retrieve, visualize, and present data as efficiently as possible. You can save time with batch scoring capabilities, plus a credit risk dashboard lets you visualize the credit profiles of a portfolio of entities. In addition, you can review concise summaries with automatically generated tear sheets that provide a company’s profile, financial highlights, and credit score.

You can also pull out all the data of interest into an Excel template.

About S&P Global Market Intelligence At S&P Global Market Intelligence, we understand the importance of accurate, deep, and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics, and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.